In many countries, the COVID-19 pandemic and other crises, including most recently the sharp increases in food and energy prices triggered by Russia’s war on Ukraine, have caused havoc to fiscal policies in several ways. During the pandemic, economic development slowed down or came to a halt, leading to revenue losses for governments. Moreover, short-term public sector emergency spending to counterbalance the adverse impact of the pandemic on the population and across sectors as well as higher spending on awareness and vaccination campaigns led to further increases in fiscal deficits. As the pandemic is receding, big recovery spending packages are being initiated that tend to widen fiscal deficits even further while often resulting in higher government indebtedness. More generally, the COVID-19 pandemic has eroded previously achieved progress in poverty reduction, widened inequality within and across countries and threatens the achievement of the Sustainable Development Goals (SDGs) by 2030. Fiscal pressures have been heightened more recently by sharp increases in food and energy prices, triggered by Russia’s war on Ukraine. These are fuelling inflation and hampering economic recovery, while adding fiscal pressures through higher spending by governments, including for subsidies and compensation packages for population groups and businesses.

These adverse impacts of the multiple crises are keeping many poorer countries around the world in tight grip, and they have exacerbated previously existing structural problems in fiscal policies. These include low levels of revenues, weak tax administrations, inadequacies in public service delivery, including in social expenditure programmes that do not sufficiently focus on needy population groups, wasteful subsidies, inadequate financial control mechanisms, procurement, and public investment programming and management. In many countries of the developing world, the pandemic thus exposed weaknesses in fiscal management, while putting pressure on governments to increase spending in a bid to at least seek to dampen the worst impacts of the COVID-19 crisis on poverty and inequalities.

These crises, however, also present an opportunity. Key opportunities for fiscal reforms and further efforts to fight the impacts of the COVID-19 pandemic and other crises should start by reflecting on the exposed weaknesses in fiscal management, then identifying key bottlenecks, and finally redoubling efforts to implement reforms to improve fiscal management. Fiscal reform efforts should strive to recover better in the sense of, making spending more focused on the alleviation of poverty and inequalities, while also addressing ecological concerns and challenges from climate change, hopefully yielding environmentally more sustainable, greener spending trajectories. A new wave of fiscal reform efforts seems needed in many countries to overcome the adverse impacts of the COVID-19 pandemic, resulting also in renewed and strong progress towards achieving the SDGs by 2030.

Good Financial Governance Approach

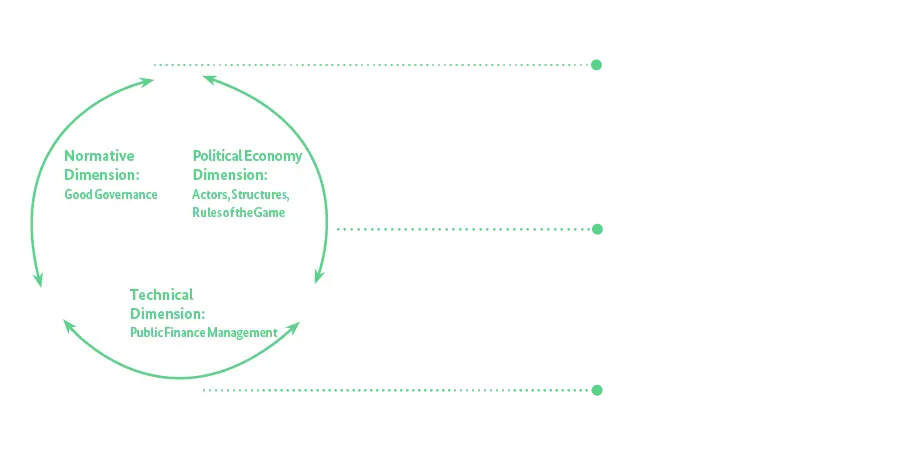

The German development cooperation takes a holistic view of fiscal policy, incorporating the normative and political-economy dimensions of policy formulation in addition to the technical dimension. Consequently, Good Financial Governance focuses on reducing poverty and inequality through fair, accountable, and transparent public financial management systems. Within this strategic approach, six main technical areas are identified: creating fair, transparent and efficient tax systems; redistributive and fair public expenditure management; using procurement systems; fiscal decentralisation; debt management; and accountability for the use of public funds.

The following topics highlight specific fiscal policy challenges that have been identified by German development cooperation as key areas of support as well as relevant resources to recover forward after the COVID-19 pandemic and other crises: