Policy-Based Lending

Achieving the 2030 Agenda through innovative financing tools

"Governance is recognised as the means to a broader end; it is an essential lever of the systemic transformations needed to achieve all 17 Sustainable Development Goals (SDGs)," notes the Global Sustainable Development Report (GSDR) 2019. The forthcoming GSDR 2023 takes this statement even further, focusing on integrative, adaptive and inclusive governance approaches as levers for Recover Forward and the necessary transformation towards sustainability. The COVID-19 pandemic has shown the resilience of governance systems and public sector institutions as well as their ability to adapt, function, and innovate, but it has also exposed underlying vulnerabilities.

The 2030 Agenda constitutes a compass for Recover Forward. Implementing the 2030 Agenda requires solid sustainable development governance as a foundation for the necessary transformation. To this end, the implementation of the 2030 Agenda and Recover Forward needs to be strategically anchored at the national government level. The Sustainable Development Goal targets and indicators need to be embedded in the respective national plans and budgets. Governments should prioritise policy coherence, to overcome sectoral silos and to align existing rules and regulations towards achieving the goals that are interlinked across sectors. Governments are required to use integrative, adaptive, informed and inclusive governance approaches with adequate capacities and abilities, including smart policy mixes.

The cornerstone for sustainable development governance consists of effective, transparent, accessible and inclusive institutions. While there are no one-size-fits-all solutions and no “silver bullets”, governance approaches need to be diverse, tailored, innovative and adaptive, using science and data to support decision-making.

The following topics provide entry points for sustainable development governance in line with Recover Forward:

Achieving the 2030 Agenda through innovative financing tools

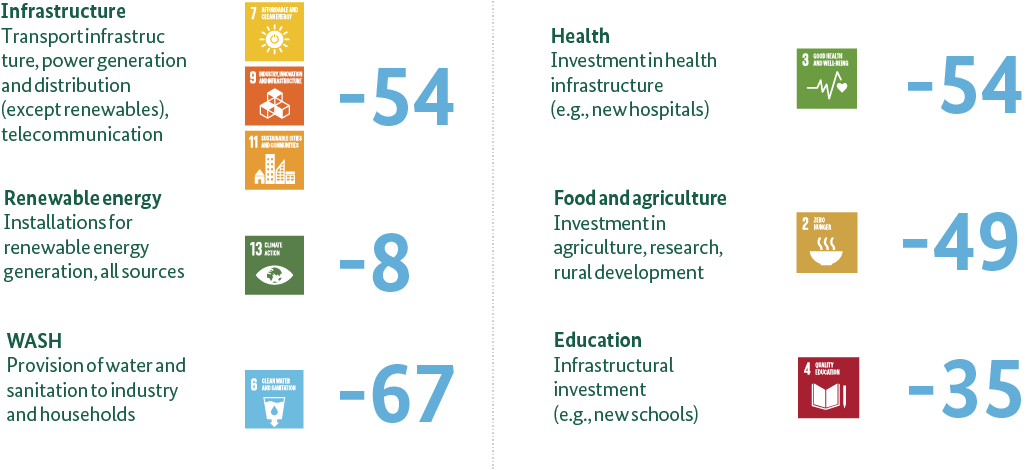

The COVID-19 pandemic has led to a severe decline in private and public investment globally, impacting sectors of high relevance for the achievement of the Sustainable Development Goals (SDGs). In developing economies, a double-digit decline of Foreign Direct Investment (FDI) compared to pre-pandemic levels was registered in already poorly financed sectors such as power, food, agriculture, and health in 2020.[1] The financial gap also widened for countries that are no longer eligible for official development assistance (ODA).

Globally, private investment alone decreased by 35%, from 1.5 trillion to 1 trillion USD the previous year, with a significant impact on sectors of key relevance for the SDGs. While the sharpest decline of FDI flow was seen in Europe, the effect of the pandemic on FDI differed immensely by region and was uneven across developing countries. In Latin America and the Caribbean, the flow fell by 45%, but by only 16% in Africa, whereas in Asia, it actually increased by 4%. Transitioning economies were affected by a decline of 58% in 2020.[2] According to a prognosis of the Organisation for Economic Co-operation and Development (OECD), the estimated annual SDG financial gap in developing countries might rise from 2.5 trillion to 4.2 trillion USD due to the COVID-19 pandemic.

The pandemic presents a unique opportunity to kick-start the urgent transformation required to achieve the 2030 Agenda and Paris Agreement. Recovering forward requires innovative, forward-oriented financing throughout all recovery measures to render economies and societies future-proof. It aims at enabling systemic change and sustainable, holistic reforms in partner countries. Policy-based lending tools can play an important role to address the structural causes of crisis and to create co-benefits and synergies between the economic, social, and environmental dimensions of sustainability. Policy-based lending is defined as funding provided to borrowing countries with the aim of supporting policy reforms and/or institutional changes.